NFTs Explained: A Beginner’s Roadmap to the Digital Asset World

NFTs Explained for Beginners simply starts with a new concept of ownership — one that lives entirely on the internet. Whether you’re seeing digital art auctions in the headlines or hearing friends talk about NFT collections, these tokens are changing how creators and collectors interact in the digital economy.

This guide aims to break down the essentials for new investors and digital explorers curious about how NFTs function, why they hold value, and whether they’re worth your time or money.

NFTs Explained for Beginners: What Are NFTs?

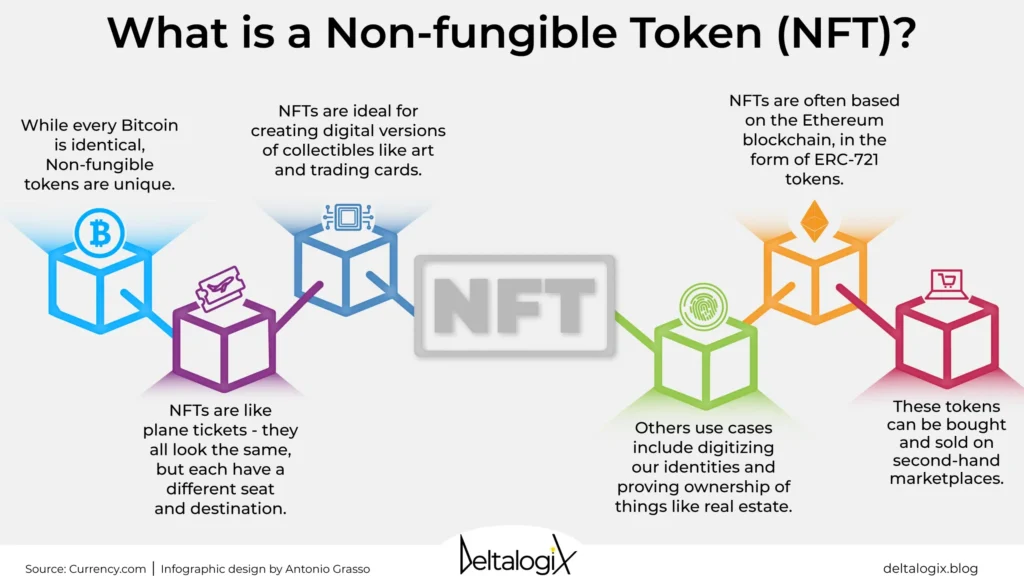

NFT stands for Non-Fungible Token. At its core, this is a unique digital asset that lives on a blockchain and can represent ownership of nearly anything — from art and music to domain names or video clips.

The term “non-fungible” means it’s one-of-a-kind. Unlike a dollar or Bitcoin (both fungible), no two NFTs are exactly the same. This uniqueness is what gives NFTs their identity and often their value.

An NFT is not the image, song, or video itself — it’s a tokenized proof of ownership for that digital asset, stored on a public blockchain.

Understanding How NFTs Work

NFTs are built using blockchain technology — typically on Ethereum, though other chains like Solana, Tezos, and Polygon are also widely used. Here’s the simplified flow of how NFTs work:

- Creation (Minting): A creator uploads a digital item (e.g., image or video) and uses a platform to convert it into an NFT.

- Tokenization: A smart contract generates metadata that is permanently stored on the blockchain. This includes ownership info, transaction history, and more.

- Sale or Transfer: The NFT can be bought or traded on marketplaces, with each transaction recorded publicly.

Smart contracts also allow creators to receive royalties automatically each time the NFT is resold — a key innovation over traditional art markets.

What Can NFTs Be Used For?

While art is the most common use, NFTs are applied in multiple industries. Here’s an overview of where NFTs are making an impact:

| Sector | Real-world Applications |

|---|---|

| Digital Art | Verifiable ownership, artist royalties, digital exhibitions |

| Music & Audio | Tokenized albums, exclusive listening rights, fan rewards |

| Gaming | In-game assets, skins, and virtual items with real-world value |

| Fashion & Luxury | Authenticity certificates, digital clothing for avatars |

| Sports & Entertainment | Player trading cards, VIP access passes, fan engagement tools |

| Real Estate (Virtual) | Virtual land ownership in metaverse platforms like Decentraland or Sandbox |

NFTs Explained for Beginners: How NFTs Are Created

Credit from DeltalogiX

Creating an NFT (known as “minting”) doesn’t require coding skills, though understanding platforms and blockchain costs helps.

- Choose a blockchain: Ethereum is the most widely used but has higher gas fees. Alternatives like Solana or Polygon offer lower fees.

- Select a marketplace: Popular options include OpenSea, Rarible, and Magic Eden.

- Connect a wallet: Digital wallets like MetaMask or Phantom are used to store NFTs and make purchases.

- Upload content & metadata: This includes the file, title, description, and properties like rarity.

- Pay the gas fee to mint: This cost varies based on blockchain activity.

Minted NFTs are permanently recorded on the blockchain and cannot be modified later.

NFTs Explained for Beginners: Why NFTs Have Value

Not all NFTs are valuable, but those that are tend to combine three core elements:

- Scarcity: Limited edition or one-of-a-kind items are more desirable.

- Provenance: Buyers can trace ownership history and verify authenticity.

- Utility: Some NFTs provide real-world benefits like event access, voting rights, or membership perks.

Social status, community involvement, and brand partnerships also contribute to demand.

NFTs Explained for Beginners: NFTs vs Cryptocurrencies

Though both NFTs and cryptocurrencies use blockchain technology, they serve different functions. This comparison helps clarify:

| Feature | NFTs | Cryptocurrencies |

|---|---|---|

| Uniqueness | Non-fungible (each item is unique) | Fungible (interchangeable) |

| Purpose | Represents ownership of digital items | Medium of exchange, value store |

| Tradability | Sold on NFT marketplaces | Traded on crypto exchanges |

| Popular Examples | Bored Apes, CryptoPunks | Bitcoin, Ethereum, Solana |

| Storage | Held in crypto wallets | Also held in wallets |

NFTs Explained for Beginners: NFT Marketplaces Overview

If you’re thinking of buying or selling NFTs, marketplaces are where it all happens:

- OpenSea: The largest NFT platform, supports Ethereum and Polygon.

- Rarible: Community-driven, lets users mint without code.

- Foundation: Curated and more exclusive, focused on art.

- Blur: Popular with professional traders and bulk collectors.

- Magic Eden: Leading marketplace for Solana NFTs.

Each platform has its own features, wallet integrations, and supported blockchains.

Are NFTs Worth Investing In?

NFT investing can be profitable, but it is also high-risk and speculative. Beginners should view NFTs more like collectibles or long-term cultural assets than quick-money opportunities.

Things to keep in mind:

- Value is often driven by hype and social media.

- Liquidity is low — it may take time to find a buyer.

- Prices are volatile and can drop quickly.

- Not all NFTs retain or increase value.

For those interested in supporting artists, accessing exclusive content, or joining niche communities, NFTs may offer genuine value. But they should not replace traditional investments like index funds or real estate.

Risks of Investing in NFTs

Before diving in, it’s important to understand the challenges and pitfalls:

- Scams and forgeries: Fake collections and phishing links are common.

- Loss of keys or access: If you lose your wallet or seed phrase, your NFTs are gone.

- Environmental concerns: Some blockchains consume high energy (Ethereum is transitioning to more eco-friendly models).

- Regulatory uncertainty: The legal status of NFTs varies by country and may affect trading.

Due diligence is essential. Read whitepapers, explore Discord groups, and use platforms like Etherscan to verify legitimacy.

Tips for NFT Investing (Especially for Beginners)

- Start small — experiment with low-cost NFTs first.

- Never invest more than you can afford to lose.

- Don’t chase hype; instead, focus on projects with long-term vision and community.

- Secure your wallet with 2FA and never share your seed phrase.

The Future of NFTs: Trends to Watch

Credit from Calibraint

NFTs are evolving beyond art into infrastructure for the web. Key trends include:

- Dynamic NFTs: Change over time based on external data (used in gaming or events).

- Music NFTs: Artists directly monetize without intermediaries.

- Token-gated communities: Exclusive spaces accessed through NFT ownership.

- Interoperability: NFTs usable across multiple games, platforms, or blockchains.

These developments suggest NFTs are moving from novelty to foundational tools in Web3 ecosystems.

Conclusion: Understanding NFTs in Context

For newcomers, getting NFTs explained isn’t just about learning acronyms — it’s about grasping a new digital economy built on scarcity, ownership, and creative freedom.

Before investing, spend time observing how people use NFTs, what communities value, and how marketplaces evolve. As with any emerging technology, NFTs offer both opportunity and uncertainty — and they’re best approached with curiosity and caution, not blind enthusiasm.